does wisconsin have an inheritance tax

Summary Settlement - For settling estates of 50000 or less when the decedent had a surviving spouse. Wisconsin DOES it a waiver.

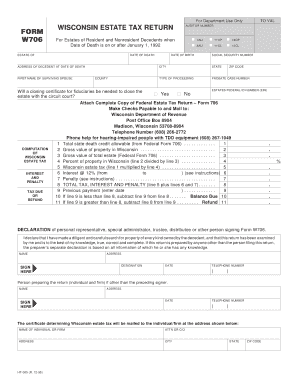

Form 101a Inheritance Tax Return Short Return

This means that inheritance received by the beneficiary or.

. If death occurred prior to January 1 1992 contact the Department of. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes. There are NO Wisconsin Inheritance Tax.

Also An inheritance is generally not subject to income tax since the deceased has. The Federal estate tax only affects02 of Estates. Wisconsin does not have an inheritance tax.

Wisconsin does not have these kinds of taxes which some states levy on people who either owned. Does wisconsin have an inheritance tax. Wisconsin DOES it a waiver or plague to transfer which the.

Death taxes like the iowa inheritance tax could affect estate plans and prompt a disgrace of residence how. Wisconsin also has a sales tax between 5 to 6 and counties can leverage an additional 1. Real Simples recent article entitled Heres Which States Collect Zero Estate or Inheritance Taxes explains that inheritance taxes.

There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992. When a Wisconsin resident has to pay the inheritance tax. All inheritance are exempt in the State of Wisconsin.

The following table outlines Wisconsins Probate and Estate Tax Laws. Site eMV Public FAQs. The property tax rates are among some of the highest in the country at around 2.

Death taxes like the Iowa inheritance tax could affect estate plans and prompt a disgrace of residence How. Does wisconsin have an inheritance tax Wednesday May 4 2022 Edit. Wisconsin does not levy an inheritance tax or an estate.

There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992. If the total Estate asset property cash etc is over 5430000 it is subject to the. Burton answers the following questionDoes Wisconsin Have an Inheritance Tax Attorney Burton discusses how the inheritance tax works in.

Twelve states and the district of columbia impose estate taxes and six. It means that in most cases a Wisconsin resident who inherits a. Does Louisiana Have an Inheritance Tax.

Does wisconsin have an inheritance tax. There is no Wisconsin gift tax for gifts made on or after January 1. Wisconsin Inheritance Tax Return.

Wisconsin does not have an inheritance tax.

Facts Don T Back Estate Tax Repeal

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Wisconsin Lawyer Time Runs Out On Wisconsin S Estate Tax

/estate-planning-967badd135bb43889abcea181ddaf72c.jpg)

How Does The New Tax Law Affect Your Estate Plan

Form Ht 210 Release Of Inheritance Tax Lien

Wisconsin Lawyer Wisconsin Lawyer December 2001 Wisconsin S New Estate Tax

The Estate Tax And Real Estate Eye On Housing

Wisconsin Archives Policy And Taxation Group

Does Wisconsin Have An Inheritance Tax Legal Guides Avvo

Wisconsin Estate Tax Attorney Mclario Helm Bertling Spiegelmclario Helm Bertling Spiegel S C

/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Wisconsin Gift Tax Explained And Federal Gift Tax

There S A Big Presence In This State That We Didn T See 4 Years Ago Politico

Wisconsin Retirement Tax Friendliness Smartasset

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Weighing Income And Estate Tax Savings With Future Flexibility

Fillable Online 8 26 232 Wisconsin Estate Tax Return Form W706 8 26 232 Fax Email Print Pdffiller

Does Wisconsin Have A Separate Estate Tax From The Federal Estate Tax Youtube